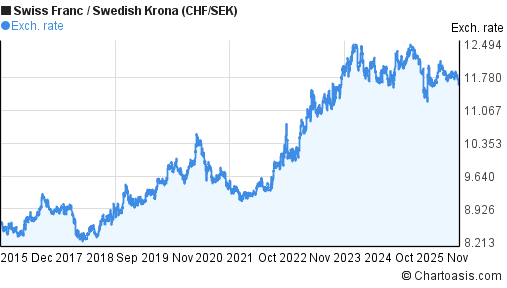

In the dynamic world of international finance, understanding currency exchange rates is paramount. The CHFSEK exchange rate, representing the conversion between the Swiss Franc (CHF) and the Swedish Krona (SEK), plays a pivotal role in global trade and investments. This guide delves into the intricacies of the CHFSEK exchange rate, its significance, influencing factors, and practical insights to help you make informed financial decisions.

Introduction: Deciphering the CHFSEK Exchange Rate

The CHFSEK exchange rate refers to the value of one Swiss Franc in terms of Swedish Krona. It’s a crucial metric in the realm of foreign exchange markets, where currencies are bought and sold. The exchange rate isn’t static; it fluctuates due to a multitude of factors, impacting trade balances, tourism, investments, and more.

CHFSEK: Understanding the Swiss Franc to Swedish Krona Exchange

The Swiss Franc, denoted by CHF, holds a reputation for stability and reliability. Switzerland’s robust economy, backed by a strong financial sector, contributes to the Franc’s global recognition. On the other hand, the Swedish Krona symbolized as SEK, represents the currency of Sweden. The CHFSEK exchange rate showcases how much one unit of Swiss Franc is worth in Swedish Krona.

Factors Influencing the CHFSEK Exchange Rate

Various factors shape the dynamics of the CHFSEK exchange rate. Understanding these factors can provide insights into its fluctuations:

1. Economic Performance

Economic indicators like GDP growth, unemployment rates, and trade balances impact both the Swiss Franc and the Swedish Krona. A stronger Swiss economy might lead to an appreciation of the Franc against the Krona.

2. Interest Rates

Central banks’ decisions on interest rates affect currency value. Higher interest rates in Switzerland could attract foreign investments, increasing the demand for the Franc and influencing the CHFSEK rate.

3. Political Stability

Political uncertainty can lead to currency fluctuations. The stability of both the Swiss and Swedish governments plays a role in determining the exchange rate.

4. Global Events

Events like geopolitical tensions, economic crises, or natural disasters impact investor sentiment and currency markets. Safe-haven currencies like the Swiss Franc might strengthen during times of uncertainty.

5. Trade Relations

Bilateral trade relations between Switzerland and Sweden impact demand for their currencies. Trade surpluses or deficits can influence the exchange rate.

Navigating Currency Fluctuations: Tips and Strategies

Dealing with currency fluctuations requires a strategic approach. Here are some tips to consider:

1. Hedging

Companies engaged in international trade often use currency hedging to mitigate risks. Forward contracts and options can provide protection against adverse exchange rate movements.

2. Diversification

Investors can diversify their portfolios by including assets denominated in different currencies. This strategy can help reduce the impact of a single currency’s depreciation.

3. Stay Informed

Keeping abreast of economic indicators, central bank decisions, and global events can provide insights into potential exchange rate movements.

FAQs

Can I predict CHFSEK exchange rate movements accurately?

Exchange rates are influenced by a complex interplay of factors, making accurate predictions challenging. However, staying informed can help you anticipate potential trends.

How frequently does the CHFSEK exchange rate change?

Exchange rates fluctuate continuously during market hours due to real-time trading activities. They can also experience significant shifts over longer periods.

Are there any tools to track CHFSEK exchange rate changes?

Yes, various financial websites and platforms offer real-time exchange rate tracking, historical data, and charting tools for analysis.

Can I profit from CHFSEK exchange rate fluctuations?

Currency trading carries inherent risks. While some investors capitalize on exchange rate movements, it’s essential to understand that losses can also occur.

Does the CHFSEK exchange rate only impact businesses?

No, the exchange rate affects anyone involved in cross-border transactions, including travelers, investors, and import/export businesses.

How can I exchange Swiss Francs for Swedish Krona?

Currency exchange can be done through banks, currency exchange offices, or online platforms. Compare rates and fees before making a decision.

Conclusion: Navigating the CHFSEK Landscape

The CHFSEK exchange rate serves as a bridge between the economies of Switzerland and Sweden. Its fluctuations are a reflection of complex economic and geopolitical factors. By comprehending these dynamics, individuals and businesses can make more informed decisions regarding investments, trade, and financial planning.

In a world of constant change, staying informed about the CHFSEK exchange rate is key to seizing opportunities and managing risks in the realm of international finance.